Figure Mortgage Rates

This free mortgage calculator lets you estimate your monthly house payment including principal and interest taxes insurance and PMI. Step 2 Multiply the number of years left in your mortgage by 12 to figure the number of payments.

3 Ways To Calculate Mortgage Interest Wikihow

The value of gross mortgage advances in 2021 Q2 was 890 billion over double the amount seen in 2020 Q2 and the highest level since 2007 Q3.

Figure mortgage rates. Mortgages can charge either fixed-rate mortgages FRM or. Homeowners with excellent credit 700 can borrow up to 1500000 with no cash out. Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule.

Interest ratethe percentage of the loan charged as a cost of borrowing. It prides itself on its efficiency and its fast pre-qualification and closing times. Computing Daily Interest of Your Mortgage.

Created with Highcharts 931 Principal. If paying the mortgage point reduce their interest rate by just one-tenth of a percent to 390 they would pay 139599 over the life of the loan or 4140 less. 30-year benchmarks have increased 14 basis points from this time last year.

Use the outstanding loan balance as the new loan amount. Figure rates requirements and costs. Lenders provide you an annual rate so youll need to divide that figure by 12 the number of months in a year to get the monthly rate.

With Figure APRs start at 300 percent. 3000000 HOA Insurance. Because they paid 2000 for the mortgage point this results in a savings of 2140 over the life of the loan.

A shorter period such as 15 or 20 years typically includes a lower interest rate. Use Zillows home loan calculator to quickly estimate your total mortgage payment including principal and interest plus estimates for PMI property taxes home insurance and HOA fees. A typical rate on a Figure Mortgage Refinance loan is 273 2793 APR.

Normally we use public records to report lenders average mortgage rates and median loan costs during the previous year. The company was founded in 2018 and was based in San Francisco California. If youre buying a 250000 home for example and you put down 50000 your resulting loan amount is 200000 and your LTV therefore is 80 ie 200000 divided by 250000.

See how changes affect your monthly payment. If you have a fixed-rate mortgage skip this step because you already know your interest rate. Competitive interest rates.

If your interest rate is 5. Then divide the monthly interest by 30 days which will equal the daily interest. To compute daily interest for a loan payoff take the principal balance times the interest rate and divide by 12 months which will give you the monthly interest.

The average loan amount of 41700700 with the average rate above would result in 360 monthly payments of 169798. Interest rates start at 288 and increase depending on your personal factors such as credit score occupancy status and loan-to-value ratio. Figure offers cash-out and traditional rate-and-term mortgage refinancing as well as home equity lines of credit.

Most fixed-rate mortgages are for 15 20 or 30-year terms. Mortgage rates have decreased 11 basis points for 30-year mortgages week over week at 298. Figure also offers both 30-year and 15-year fixed terms for their refinances giving borrowers options when it comes to their refinance schedule.

Loan Variety - 45 5. Loan-to-Value is your loan amount divided by the value of the property. FIGURE is an online lender that offers home equity lines of credit cash-out mortgage refinances and student loan refinancing.

R your monthly interest rate. That allows us to compare. Loan-to-Value LTV is one of them.

You have a hybrid-ARM loan balance of 100000 and there are ten years left on the loan. The company is noteworthy for its jumbo loans. For example a borrower holds a mortgage at a 5 interest rate with 200000 and 20 years remaining.

The rates that Figure offers are highly competitive across the board. As of early April 2021 the average HELOC rate is 461 percent. A typical rate on a Figure Purchase Mortgage loan is 273 2836 APR.

The origination fee ranges from 0 to 499 and you may choose to pay a higher origination fee in exchange for a reduced annual percentage rate. Breaking down the home purchase figures further 2332 were loans to first-time homebuyers 1115 were for buy-to-let mortgages and 3960 was classified as other. Short bond rate DKK Long bond rate DKK Short bond rate EUR Week 45-057.

Looking at new commitments 7181 were for home purchases while 2359 were for remortgages. Enter the new or future interest rate. The rates are especially attractive if you have a good or excellent credit score.

If this borrower can refinance to a new 20-year loan with the same principal at a 4 interest rate the monthly payment will drop 10795 from 131991 to 121196 per month. The value of new mortgage commitments lending agreed to be advanced in the coming months was almost 25 times greater than a year earlier at 856 billion but 21 billion lower than the recent peak seen in 2020 Q4. 7200000 HOA Insurance.

Your interest rate is about to adjust to 5. 15-year benchmarks have decreased 7 basis points from this week last year.

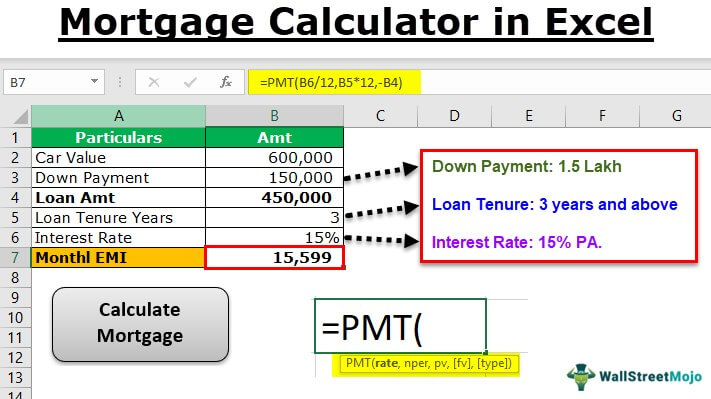

Excel Mortgage Calculator Calculate Mortgages Using Excel Functions

How To Calculate Monthly Mortgage Payment In Excel