Figure Mortgage Payment

Mortgage Calculator Use this calculator to estimate the monthly repayments for your dream home. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more.

Simple Mortgage Calculator Template Formidable Forms

For example if you have a 15-year loan and make monthly payments.

Figure mortgage payment. The TD Mortgage Payment Calculator uses some key variables to help estimate your mortgage payments. Term and Interest rate. There are 26 bi-weekly periods in the year but making only two payments a month would result in 24 payments.

This free mortgage calculator lets you estimate your monthly house payment including principal and interest taxes insurance and PMI. The monthly payment amount stated does not include taxes and insurance which will result in a higher payment if these amounts are escrowed. A mortgage payment typically consists of four components often referred to as PITI.

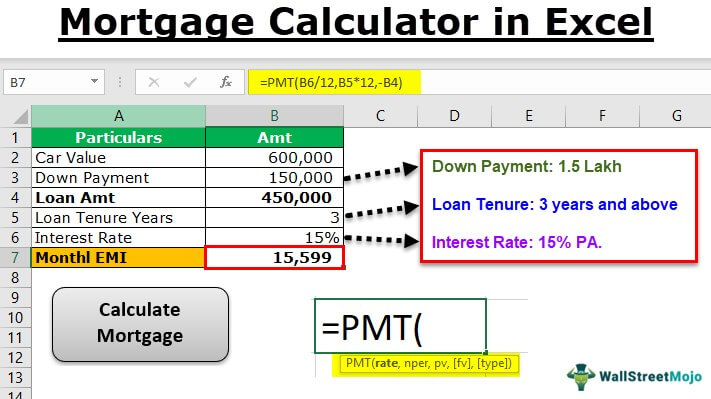

To calculate monthly mortgage payment you need to list some information and data as below screenshot shown. You can calculate your monthly mortgage payment by using a mortgage calculator or doing it by hand. Use Zillows home loan calculator to quickly estimate your total mortgage payment including principal and interest plus estimates for PMI property taxes home insurance and HOA fees.

Next add 1 to the monthly rate. O If you are going to buy a 200000 house and you can pay 10000 down your loan amount will be about 190000. Divide the annual interest figure by 12 months to arrive at the monthly interest due.

How to estimate mortgage payments. Over the course of the year you will have paid the additional month. Before you apply for loans review your income and determine how much youre comfortable spending on a mortgage payment.

M Pr1rn1rn-1 M the total monthly mortgage payment. Third multiply the number of years in. Principal interest taxes and insurance.

Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. The formula for mortgage basically revolves around the fixed monthly payment and the amount of outstanding loan. A typical rate on a Figure Purchase Mortgage loan is 273 2836 APR.

15 x 12 180. PrincipalThis is the total amount of money you borrow from a lender. Youll need to gather information about the mortgages principal and interest rate the length of the loan and more.

A typical rate on a Figure Purchase Mortgage loan is 273 2836 APR. O Plug those numbers into your calculator. Instead of paying twice a week you can achieve the same results by adding 112th of your mortgage payment to your monthly payment.

See how changes affect your monthly payment. O Your monthly mortgage PITI payment will be about 1520 per month. This is the purchase price minus your down payment.

That number is 500. Also offers loan performance graphs biweekly savings. Choose a term and interest rate that best suits your needs and your timeline.

See a breakdown of your monthly and total costs including taxes insurance and PMI. A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other m. The fixed monthly mortgage repayment calculation is based on the annuity formula.

Be advised this figure is only an estimate - a simple way to get an. Use our free monthly payment calculator to find out your monthly mortgage payment. But if youd like to understand how to figure it out on your own read on.

O The math looks like this. Check out the webs best free mortgage calculator to save money on your home loan today. To do so multiply the length of the loan by payment frequency.

Then in the cell next to Payment per month B5 for instance enter this formula PMTB2B4B5B10 press Enter key the monthly mortgage payments has been displayed. The average loan amount of 41700700 with the average rate above would result in 360 monthly payments of 169798. Equation for mortgage payments.

First take your principal loan balance of 100000 and multiply it by your 6 annual interest rate. Where n is the term in number of months PMT monthly payment i monthly interest rate as a decimal interest rate per year divided by 100 divided by 12 and PV mortgage amount present value. R your monthly interest rate.

The third step to calculating mortgage payments is to determine how many payments you will make over the life of the loan. P the principal loan amount. The average loan amount of 41700700 with the average rate above would result in 360 monthly payments of 169798.

392 rows This calculator figures monthly mortgage payments based on the principal borrowed the. 6 The annual interest amount is 6000. N L x PF.

Select Region United States. To figure your mortgage payment start by converting your annual interest rate to a monthly interest rate by dividing by 12. The monthly payment amount stated does not include taxes and insurance which will result in a higher payment if these amounts are escrowed.

Monthly mortgage payments are calculated using the following formula. P M T P V i 1 i n 1 i n 1.

How To Calculate Your Monthly Mortgage Payment Given The Principal Interest Rate Loan Period Youtube

Simple Mortgage Calculator With Python And Excel By Pendora The Startup Medium

3 Ways To Calculate Mortgage Interest Wikihow