Figure Bank Charter

Figure leverages its Provenance blockchain for loan origination servicing financing and now private fund services. Figure out your finances in minutes.

Brex Applies For Bank Charter Taps Former Silicon Valley Bank Exec As Ceo Of Brex Bank Techcrunch

Figure Technologies Inc.

Figure bank charter. Figure Technologies a fintech founded by former SoFi CEO Mike Cagney applied for a national bank charter through the Office of the Comptroller of the Currency OCC the company announced Friday. Figure Technologies Figure a leader in transforming financial services through the power of blockchain technology has applied for a national bank charter from the Office of the Controller of the Currency OCC. Figure CEO Mike Cagney said in an email that under a state regulatory structure the company will need more than 200 state licenses in 2021.

ABA and six other industry trade groups today urged the OCC to postpone its consideration of a charter application submitted by Reno Nevada-based Figure Bank. Charter application and the Parties proposed schedule for proceeding with or resolving the present case. Figure a leader in transforming financial services through the power of blockchain technology today announced it has applied for a national bank charter from the.

The company is focused on issuing home equity lines of credit on a private blockchain network the Provenance platform. The firm is looking for a charter to reduce the. The firm said in its announcement that the national bank charter would allow it to offer the same set of.

Cagney also said that Figure head of lending CD. Financial services firm Figure Technologies Inc. Figure plans to add deposit accounts and point-of-sale credit through a mobile app according to its application for a bank charter.

This national bank charter will be instrumental in our efforts to continue to develop and deliver new financial products and services to communities across this country that really havent had access to affordable offerings. The groups raised significant concerns about the application including the implications of granting a bank charter to an organization that only accepts uninsured deposits. Founded by former Sofi executives Figure uses its Provenance blockchain for loan origination servicing financing and private funds.

Blockchain and a bank charter might do much to boost financial inclusion. The OCCs licensing division receives analyzes and decides filings to establish change the structure of or change the activities performed by national banks federal savings associations and federal branches and agencies of foreign banks. The company founded by former SoFi.

Apply 100 online in minutes. Figure Technologies a US-based blockchain technology firm has applied for a national bank charter from the Office of the Comptroller of the Currency OCC. Charters Licensing Overview.

As reported in early November 2020 Figure Technologies had applied for a US national bank charter and has also announced a new CEO for Figure Bank. A joint letter commenting on Figures charter application submitted to the OCC by a group of seven trade associations describes the application as containing only a skeletal description of the banks proposed activities. The Figure Bank charter application is deficient because it does not adequately explain the activities that Figure Bank intends to undertake and the services the bank proposes to provide.

Figure Technologies a blockchain-based startup for providing loans against mortgage equity has become the latest fintech player to apply for a bank charter. Office of the Comptroller of the Currency would simplify. Choose from a Purchase Mortgage Mortgage Refinance Home Equity Line or Personal Loan.

A national bank charter would enable Figure to offer a cohesive set of products and services nationwide reduce its legal and regulatory costs and risks focus its compliance efforts on the requirements of a single regulator and offer its customers and business partners the security of dealing with a federally regulated and supervised national bank. The licensing division works closely with the agencys supervisory and. The company was founded in 2018 by serial.

Banking system together the Associations appreciate the opportunity to comment on the application by Figure Bank National Association Reno Nevada Applicant for a national bank charter submitted to the Office of the Comptroller of the Currency on November 6 2020. Bank charter Figure Technologies a blockchain-based financial lender has applied for a national bank charterApproval by the US. Davies will become the CEO of Figure Bank following the receipt of bank charter from the OCC.

CSBSs uncertainty as to whether Figure Bank will receive deposits apparently reflects the limited information in Figures charter application. Has sought a national bank charter from the Office of the Controller of the Currency OCC which will let it meet promises of efficiency. Figure initially offered a fixed-rate home equity loan product allowing customers to borrow.

The undersigned trade associations1 represent banks and credit unions that make up a wide cross-spectrum of the US. Figure offers a simpler faster way to find the loan thats right for you. Figure powered by blockchain.

A national bank charter would consolidate supervision with the OCC. In particular the application refers to provision of low-fee deposit accounts with payment capabilities. A bank charter would help Figure distribute its expanding blockchain-powered product suite nationwide.

The firm believes that a bank charter will allow it to simplify its compliance efforts and help it serve more customers According to a Nov. A national bank charter would allow Figure to offer a cohesive set of products and services nationwide focus its compliance efforts on the requirements of a single regulator reduce its legal and regulatory costs and risks and offer its customers and business partners the security of dealing with a federally regulated and supervised national bank. Following the conclusion of the 90-day stay the Parties agree to confer and submit to the Court a Joint Case Status Report addressing the status of the OCCs plans with respect to processing applications for uninsured national bank charters including the Figure Bank NA.

A national bank charter would allow Figure to offer a cohesive set of products and services nationwide focus its compliance efforts on the requirements of a single regulator reduce its legal and. While many digital-first companies springboard from payments into lending Figure Technologies a. 6 announcement Figure Technologies applied for a national bank charter from the Office of the United States Comptroller of the Currency OCC.

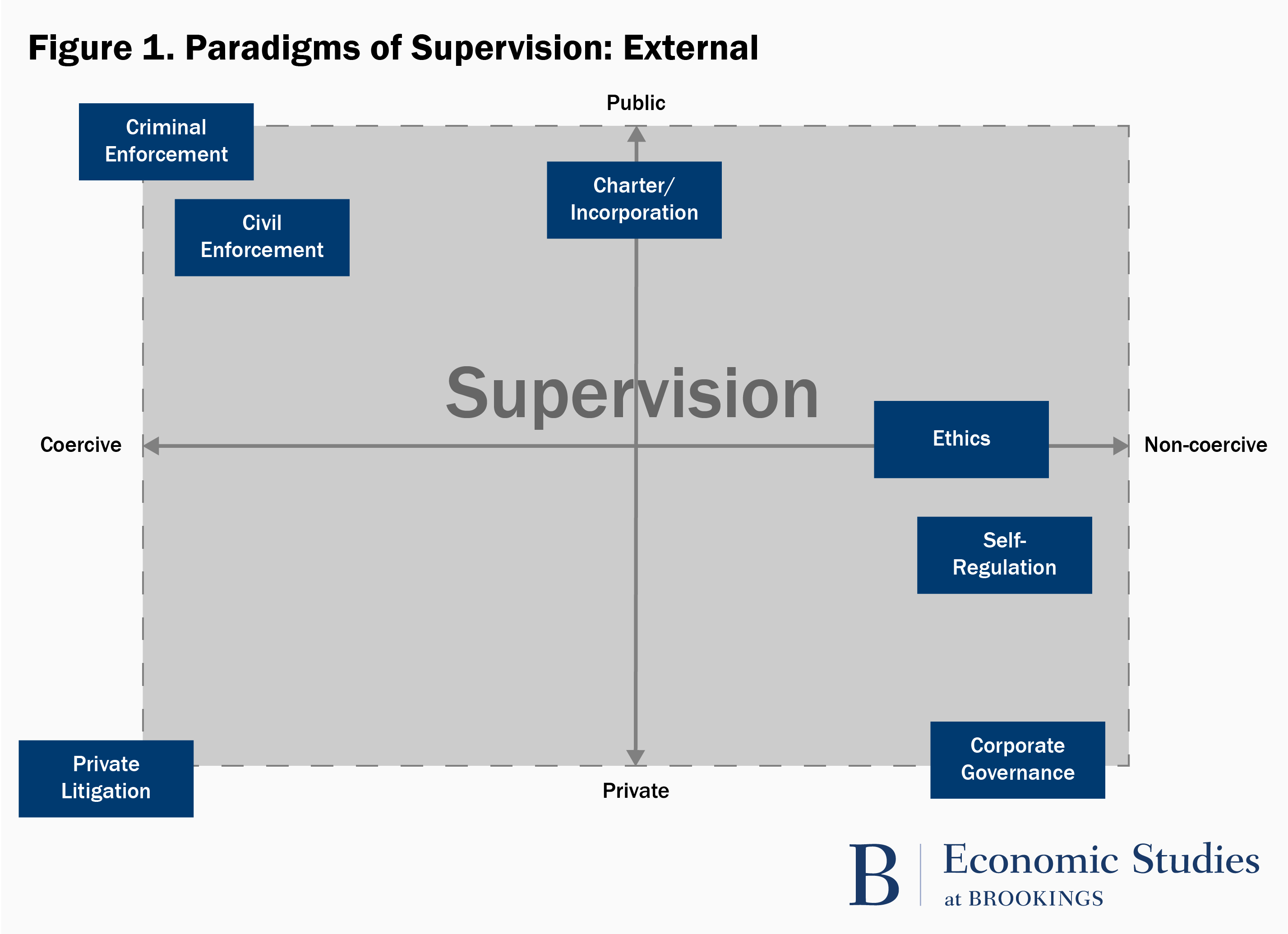

Focus On Bank Supervision Not Just Bank Regulation

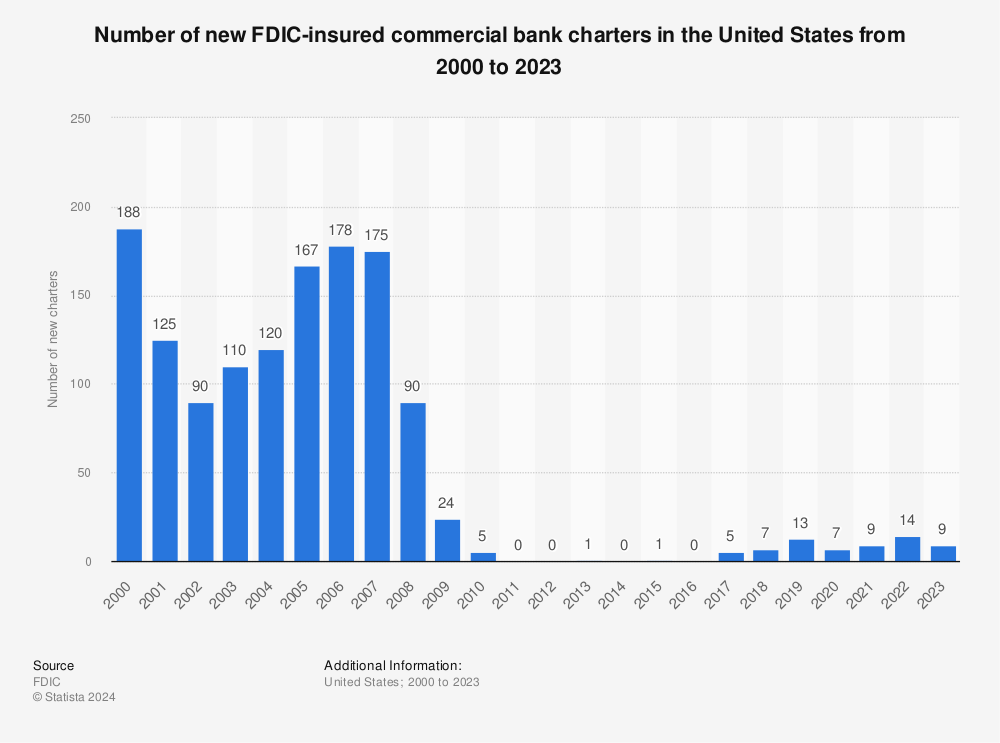

Number Of New Fdic Insured Commercial Bank Charters 2020 Statista