Figure Heloc Process

Availability may be limited by geography and home type but it could be a good fit if you. Figure is an online lender that focuses on HELOCs.

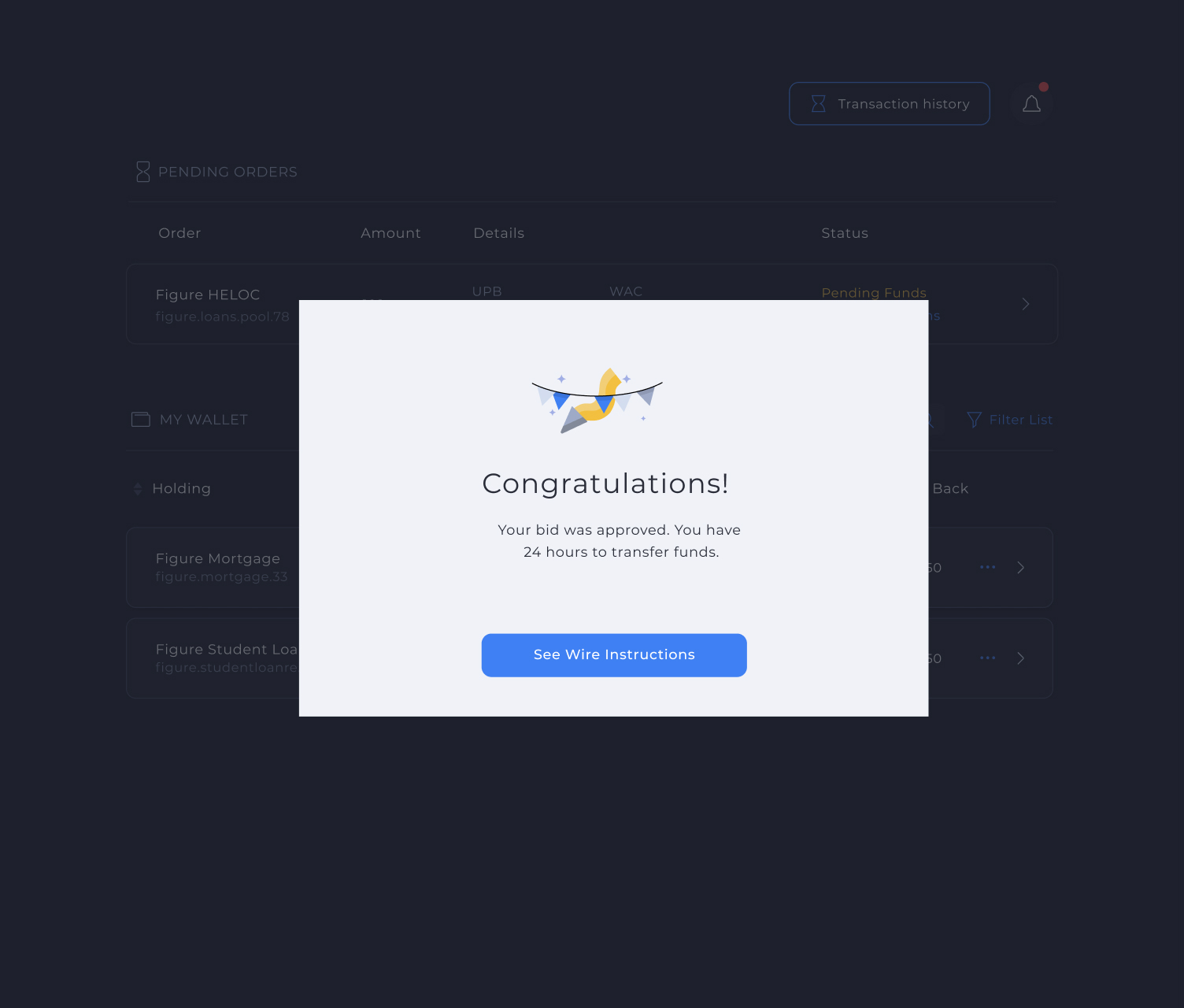

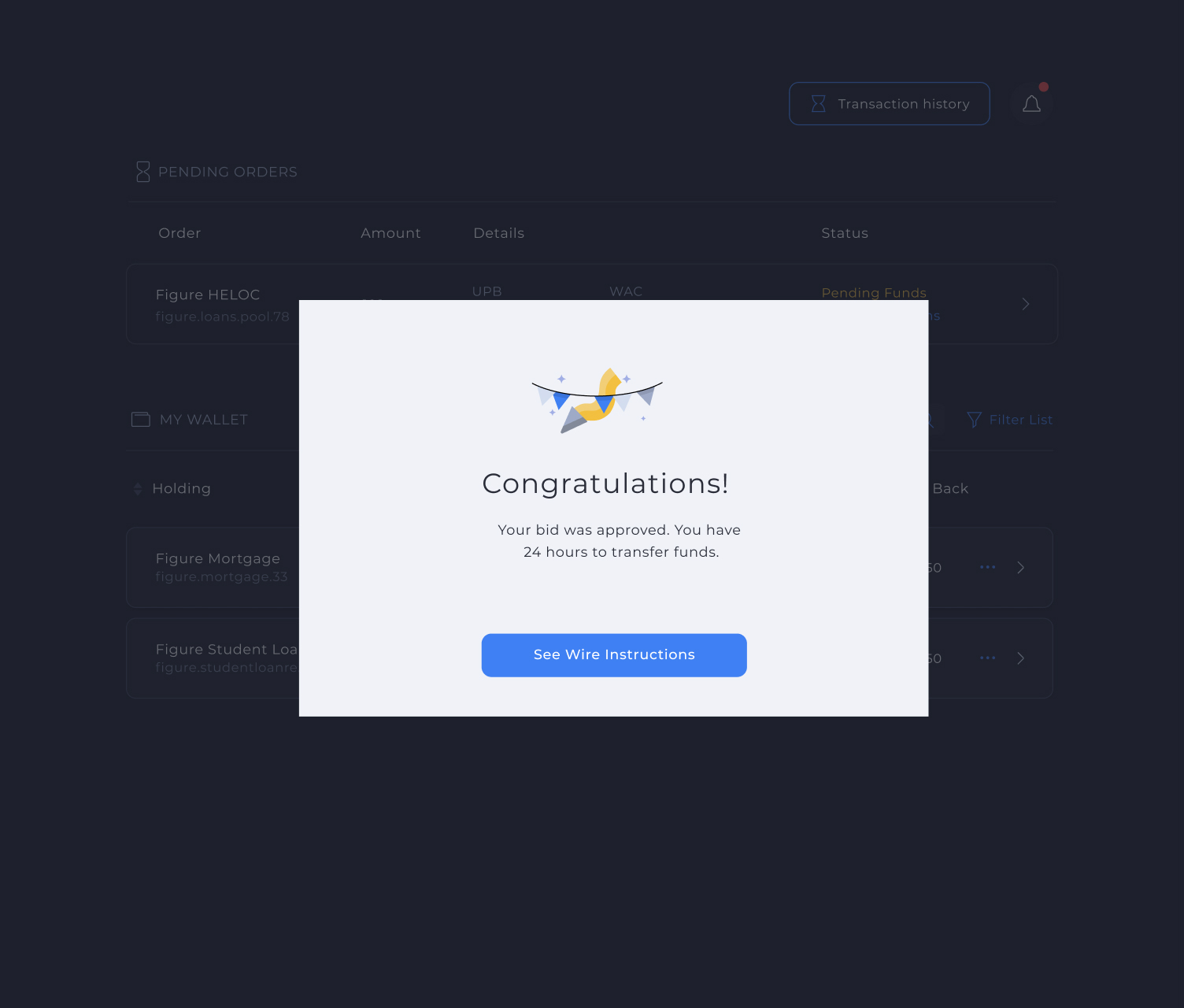

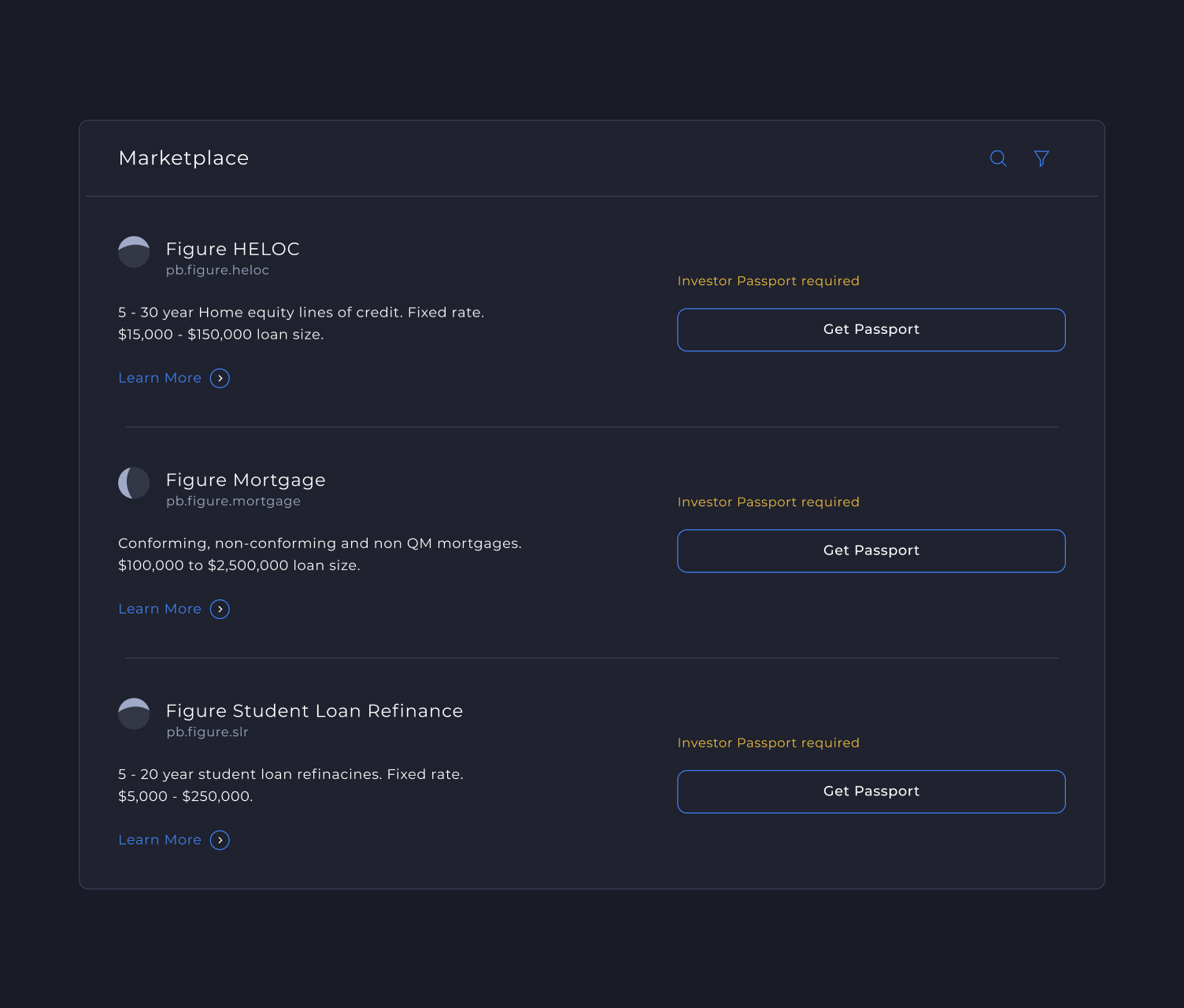

Figure For Businesses Loan Trading Marketplace

The initial amount funded at origination will be based on a fixed rate.

Figure heloc process. Pacific Time Monday through Saturday excluding holidays. The approval process is online and fully automated making it easy to get a quote on your own terms - no dealing with phone calls to brokers. Figure offers a completely digital home equity line of credit application and approval process.

How a HELOC from Figure Works. For Figure this meant focusing on the HELOC. Live chat help is available from 6 am.

One of the stand-out characteristics of Figure is that the company is a pioneer of innovative financial technologies. With Figure your entire HELOC application is online with virtual meeting and notary supports. The firm claims its technology could save 30 billion in costs for the 3 trillion annual securitisation market if applied widely.

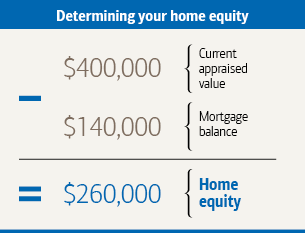

A standard procedure for the bank or lender in the HELOC process is to conduct an appraisal to determine the homes current value. Taking out a home equity line of credit isnt always an ideal option for homeowners but if you have an urgent need to consolidate debts pay off a major purchase andor fund home repairs and renovations then Figures HELOCs are great places to start funding your expenses with a reasonable interest rate and competitive loan terms. Figure offers an easy to use online home appreciation calculator.

In addition to their home equity line product the company launched Figure Home Advantage in 12 cities across US a sell-and-lease-back product where Figure buys your home and leases it back to you. The traditional home equity process has a timeline of 45 days but this timeline is around 5-7 days for Figure. The dispute process may be delayed if the information received is insufficient to identify your account or the information being disputed.

Anyone whos ever borrowed a mortgage or home equity line of credit HELOC knows that the traditional loan-closing process takes much longer than that usually 30 to 60 days. Figure is a home equity lender that uses blockchain artificial intelligence AI and analytics technology to streamline what was previously a very time-consuming borrowing process. Once these details are reviewed and verified along with a check of credit Figure can approve and fund a home equity line of credit in five business days.

Bank approves the loan and sets the HELOC limit. Home equity line of credit You can also land low APR rates on your home equity line of credit through Figure. Whats more the online quote process can render an approval in as little as five minutes and funding in as little as five days.

Figure says it can approve a HELOC in five minutes and fund the loan in five days instead of the typical 30 to 60 days. However home equity lines of credit have largely been left behind. In order to open your home equity line of credit you will need to pay a one time origination fee of up to 499 of the initial draw amount and you may also be required to pay recording fees charged by the county where your property is located.

Figure will generally respond to your credit bureau within 30 days. Figure HELOC offers closings in as few as 5 days. While the companys hallmark offering is home equity line of credits Figure is also involved in a number of other financial products such as reverse mortgages.

The Figure Home Equity Line is an open-end product where the full loan amount minus the origination fee will be 100 drawn at the time of origination. You can complete the initial application online in about 5-10 minutes and youll typically know right away whether youve been approved. If youre after a home equity line of credit HELOC Figure offers a modern technologically-driven application and approval process for its HELOCs.

Founded in 2018 Figure uses blockchain technology and artificial intelligence to approve home loans in minutes and fund them in five days. They advertise themselves as the Worlds Fastest HELOC - with a loan decision in 5 minutes and funding in as few as 5 days if youre approved. Credit Disputes PO Box 40534 Reno NV 84504.

However this product contains an additional draw feature. To start the process of applying for a Figure Home Equity Line youll need to visit the companys website and click Find My Rate Youll be asked to complete a. Over the past decade the origination processes for many types of loans have undergone optimization personal loans business loans auto loans etc.

To start the application process head to the Figure website and click on Find my rate. They usually take about 45 days to process are paperwork-heavy and involve expensive fees. Figure Home Equity Line.

The closing process is done electronically as well with the help of a video notary in states that allow for it. Figure offers a streamlined HELOC approval process that lets you get funding in as few as five days 1. Theres a digitization process that introduces a pretty significant savings and drives a very high contribution margin for the product.

Why Figure is the best home equity line of credit for fast funding. Figure said that last month it originated more than 59 million of HELOCs on blockchain providing every client with the five-minute approval and five-day funding that Figure promises. Approvals can take as little as five minutes and funding can occur in as little as five days.

Launched as recently as 2018 Figure is an online FinTech platform that specializes in consumer financing. The company which was established by Mark Cagney the founder of SoFi is paving the way in the home equity loan field by being the first company to utilize these technologies in its lending process. Figure Lending LLC Attn.

Also it is good to note that there are no hidden charges for products such as HELOC from Figure eg maintenance fees appraisal fees late fees and prepayment penalties. Figure has an all-digital HELOC which includes an online application e-notary and e-signatures. Figure promises an easy online application process with approval in five minutes and funding in as few as five business days.

Figure For Businesses Loan Trading Marketplace

How To Calculate Your Home S Equity Loan To Value Ltv Tips

A Guide To Choosing The Best Loan Best Loans Loan Types Of Loans