Figure Lending Stock

In addition we believe there would be value in collecting data at the firm level on the. Trade on Stocks Online with Globally Regulated Brokers Buy Sell UKEU US Stocks.

Free Apple share and level 2 market data giveaway.

Figure lending stock. Ad Trade global markets with one account. Trade CFDs on Stocks From the Stock Market. Ad Trade global markets with one account.

Amazon is growing. The annualized lending interest rate is market-driven and can fluctuate daily based on several factors including but not limited to borrowing demand market supply and short selling. By Ledger Insights.

Trade multiple global securities including stocks options futures etfs and reits online. Trade CFDs on Stocks From the Stock Market. Figure 8503 followers on LinkedIn.

Trade on Stocks Online with Globally Regulated Brokers Buy Sell UKEU US Stocks. Returns as of 11212021. Figure was founded by Mark Cagney the former CEO of financial services firm SoFi.

C65 and C66 discontinued. Ad Buy EU UK US Stocks With Regulated Stock Dealing Accounts. Figure is transforming the trilliondollar financial services industry using blockchain technology.

The Securities Lending and Borrowing mechanism allows short sellers to borrow securities for making delivery. And is headquartered in San Francisco California. In three short years Figure has unveiled a series of fintech firsts using the Provenance blockchain for loan origination equity management private fund services banking and.

With Real Time Charts and Tools. Figure powered by blockchain. The company is owned by Figure Technologies Inc.

Figure is transforming the trillion. That being said two stocks that are likely to provide solid returns to investors in that environment are Amazon NASDAQAMZN and eBay NASDAQEBAY. Interest rates change daily so your exact interest rate will depend on the date you apply and lock your rate.

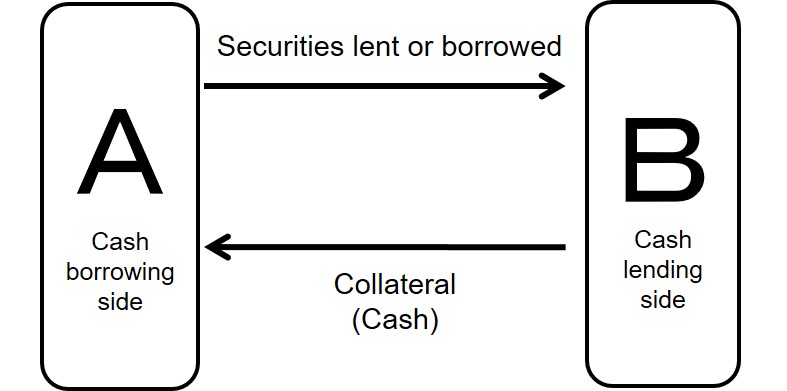

Message From Figure Lending LLC. Figure is leading that transition from the front and is bringing radical change to finance and lending markets. 1 principal amount 2 interest rate or lending fee for certain securities loan transactions 3 collateral type 4 haircut 5 tenor and 6 counterparty.

Ad Free Demo Account For Practice. A typical rate on a Figure Purchase Mortgage loan is 273 2836 APR. This guide the Product Guide describes the Clearstream Banking Automated Securities Lending programme ASL programme as contained in the Securities Lending and Borrowing Rules as amended from time to time.

Provenance was developed by Figure Technologies which was started by Mike Cagney the former CEO of SoFi. A typical rate on a Figure Mortgage Refinance loan is 273 2793 APR. Ad Buy EU UK US Stocks With Regulated Stock Dealing Accounts.

Trade multiple global securities including stocks options futures etfs and reits online. 2018 Funding to Date. With Real Time Charts and Tools.

Compare Choose Yours. Lending trades would need to be collected at the firm level. 47038MM Figure is the developer of a web-based platform that manages digital assets and can be used for completing financial and investment transactions.

While shares are on loan you will accrue interest daily at an annualized interest rate that will be paid to your account monthly. A month ago Figure announced a 65 million Series B round bringing. Bank customer lending stocks C66 This data shows lending at each point in time including the number and value of Business Finance Guarantee Scheme approvals showing what has been drawn down and what remains undrawn.

Founded in 2018 Figure Lending LLC is a finance and technology company that offers homeowners cash-out and traditional rate-and-term refinancing of home mortgages home equity lines of credit personal loans and more. For example for a borrower with a CLTV of 45 and a credit score of 800 who is eligible for and chooses to pay a 499 origination fee in exchange for a reduced APR a five-year Figure Home Equity Line with an initial draw amount of 50000 would have a fixed annual percentage rate APR of 300. When he applies for a home loan the 52week average stock price is 15.

Free Apple share and level 2 market data giveaway. Today Provenance Blockchain Inc announced that it completed a 20 million security token offering STO for the permissioned provenanceio lending platform. Stock Advisor launched in February of 2002.

An employee stock purchase plan ESPP is a company-run program in which participating employees can purchase company stock at a discounted price. Cumulative Growth of a 10000 Investment in Stock Advisor Calculated by Time-Weighted Return. Figures specific focus is on mortgages and loans using a blockchain as the technological basis for the lending process.

Ad Free Demo Account For Practice. That means for qualifying purposes Lucas monthly income from the RSUs is. It goes through the service step-by-step.

Founded in 2018 Figure has raised about 225 million to date with a valuation north of 1 billion at the time of its last raise in December 2019. Securities Lending and Borrowing or stock lending and borrowing refers to the act of lending or borrowing shares. Compare Choose Yours.

Choose from a Purchase Mortgage Mortgage Refinance Home Equity Line or Personal Loan.

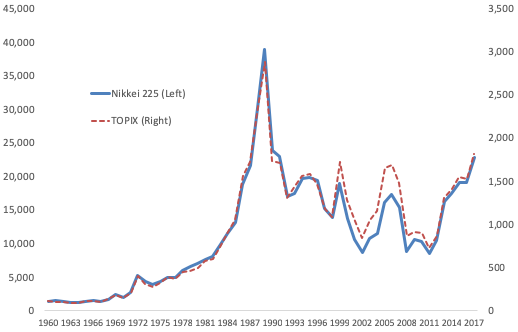

The Effectiveness Of The Bank Of Japan S Large Scale Stock Buying Programme Vox Cepr Policy Portal

Voxeu Org Sites Default Files Image Frommay2014

/AStockTicker3-b2e09bfee6254daca63b0374104144fc.png)