Figure Mortgage Refinance Reviews

If you need 50000 you refinance into a 250000 mortgage. Mortgage refinancing is when a homeowner takes out another loan to pay offand replacetheir original mortgageA mortgage refinance calculator can.

Dbs Home Equity Income Loan Review Investment Moats

The lender fares a little better on Trustpilot where it gets a TrustScore of 30 out of 5 stars based on reviews from 2517 users.

Figure mortgage refinance reviews. Learn more about Figures previous refi product and find current refinancing options. The average loan amount of 41700700 with the average rate above would result in 360 monthly payments of 169798. Ive actually borrowed from Figure before and paid the loan off extremely early.

As of November 2021 SoFi has an A rating with the Better Business Bureau for closing 255 complaints over the past three years and it earned 122 out of 5 stars from customers based on 76 customer reviews. Borrowers can get a fixed-rate HELOC between 15000 and 250000 with repayment terms of. Figure Lending LLC Review Figure Lending LLC was founded in 2018 and is based in Reno NV.

Property value loan balance etc. Reports marked to not receive prescreened credit. Figure does not currently offer 15-year jumbo loans at this time.

The 200000 mortgage can be refinanced into a larger mortgage. Getting a home equity line is often cumbersome and requires visits to the bank and lots of paperwork. However Figure is different from many other home lenders because of its completely digital experience fast approval and closing and competitive rates and fees.

The difference is the amount of cash you need. If I was in need of mortgage refinancing and Figure was able to offer the best loan terms I am fairly certain I would move forward with this company. Heres our review of the Figures home mortgage refinance product updated for November 2021.

A typical rate on a Figure Purchase Mortgage loan is 273 2836 APR. Customers are generally satisfied with the speed of the application and approval process and. Who should use Figure.

Figure Lending has stopped offering student loan refinancing. Its at 100 if everybody recommends the provider and at. The original 200000 mortgage is paid off and you receive 50000 in cash.

Figure often sends me new promotional offers. Its absolutely inappropriate to promise funding within a specified time during a global pandemic only to not deliver. Of nearly 900 reviews at the time of writing 91 ranked Figure as excellent and another 4 described it as great That compares well with many other lenders.

The main reason Figure earns our lowest ranking among companies offering mortgage refinancing is their F rating from the Better Business Bureau. A typical rate on a Figure Mortgage Refinance loan is 273 2793 APR. The BBB showed that no one from Figure responded to complaints filed and customer reviews there were mostly negative too.

Figure is one of the newest ways to get a mortgage refinanced but are they the best. For a 30-year jumbo loan you can borrow up to 80 of your homes value max 2000000 for a cash-out refinance and rate refinance. Figure earns an impressive 47 out of 5 from Trustpilot based on over a thousand customer reviews.

Learn more about Figure Lending LLC and its products by browsing the services it offers. For a 30-year conforming loan your refinance loan range is 75000 to 822375 subject to countly limits and including the option to cash out. It doesnt have any regulatory actions filed against it with the Nationwide Mortgage Licensing System.

This product is mostly recommended by SuperMoney users with a score of 42 equating to 38 on a 5 point rating scale. Although I did not move forward with refinancing my mortgage with Figure it was a smooth learning process. You can also read our community reviews and hear what others have to say about their experience with Figure Lending LLC.

Figure offers home equity loans for any use including home improvement. In 2020 the Consumer Financial Protection Bureau received three complaints related to Figures home equity line of credit product. The company is not yet rated with the Better Business Bureau.

Figure makes the process much easier and you can have your funds in just a few days. Those looking to refinance their mortgage. On which they had already researched my.

Figures Trustpilot page paints a much better picture. Figure has received mixed customer reviews to date. Unfortunately the experience this time was extremely stressful.

Offers so I am also filing a complaint that they. Figure offers mortgage refinance but its only home equity product is its HELOC. It has a rating of 47 out of 5 stars from almost 1400 reviews with approximately 7 of customer ratings falling below Great.

It doesnt fare as well with the Better Business Bureau where it receives an F rating. The company gave a timely response to all three and all were closed with an explanation. Figures rates are competitive in the industry and those with excellent credit may be able to receive lower rates than competing products.

I had my credit. Because you have a bigger mortgage your monthly notes will be higher. These businesses generally aim to provide streamlined financial services through the use of technology.

Recommendation score measures the loyalty between a provider and a consumer. Mixed customer reviews and an F from the Better Business Bureau plus more than a dozen states whose residents are ineligible for their loans are just a few of the reasons why Figure lands near the bottom of our list.

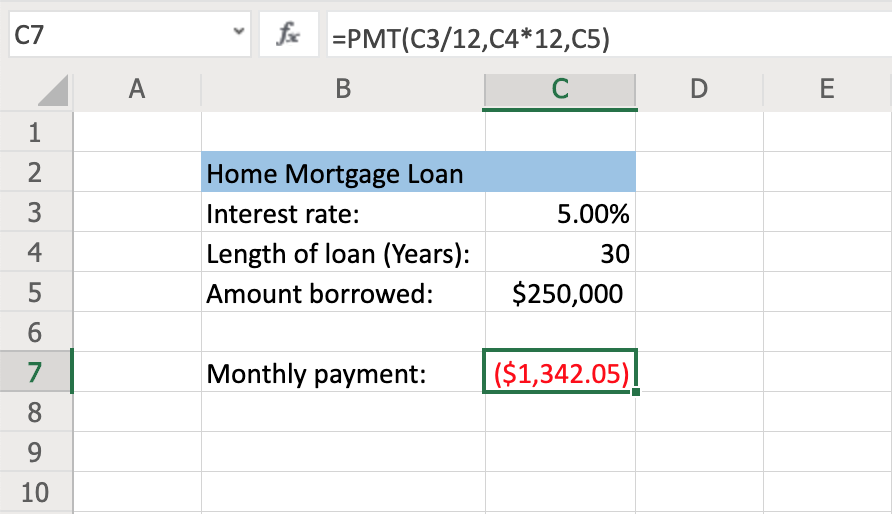

How To Calculate Monthly Loan Payments In Excel Investinganswers

/images/2019/11/20/figure_loan_review.jpg)

Figure Home Loan Review 2021 Refinance Online In Just Minutes Financebuzz

Figure Review My Experience Using Figure