Figure Lending Refinance Reviews

While researching Figure I created an account to understand the features of the company better. Figure is one of the newest ways to get a mortgage refinanced but are they the best.

Figure Review My Experience Using Figure

Figures Trustpilot page paints a much better picture.

Figure lending refinance reviews. With interest rates at an all time low the sub is being bombarded with people looking for info regarding refinancing. Getting a home equity line is often cumbersome and requires visits to the bank and lots of paperwork. Advice for those looking to refinance their mortgage.

Mortgage refinance rates have been hovering near historic lows for quite some time now. Visit our TrustPilot page to submit a review we love to hear your stories and experiences. Figure is an online lender that focuses on HELOCs.

The Consumer Financial Protection Bureau had no student. Figure an online lender founded in 2018 provides options to homeowners seeking either a home equity line of credit or a home mortgage refinance. We ask our members to review us using Trustpilot.

However the companies Lending Tree works with do hard inquiries. Mixed customer reviews and an F from the Better Business Bureau plus more than a dozen states whose residents are ineligible for their loans are just a few of the reasons why Figure lands near the bottom of our list. My experience researching Figure.

If your current mortgage rate is higher than 35 or 4 it may be worth your time to consider refinancing your mortgage soon. Additionally you might consider a refinance if your monthly payment is unaffordable or your creditworthiness has improved since you first bought your home. My wife and I have had numerous loans.

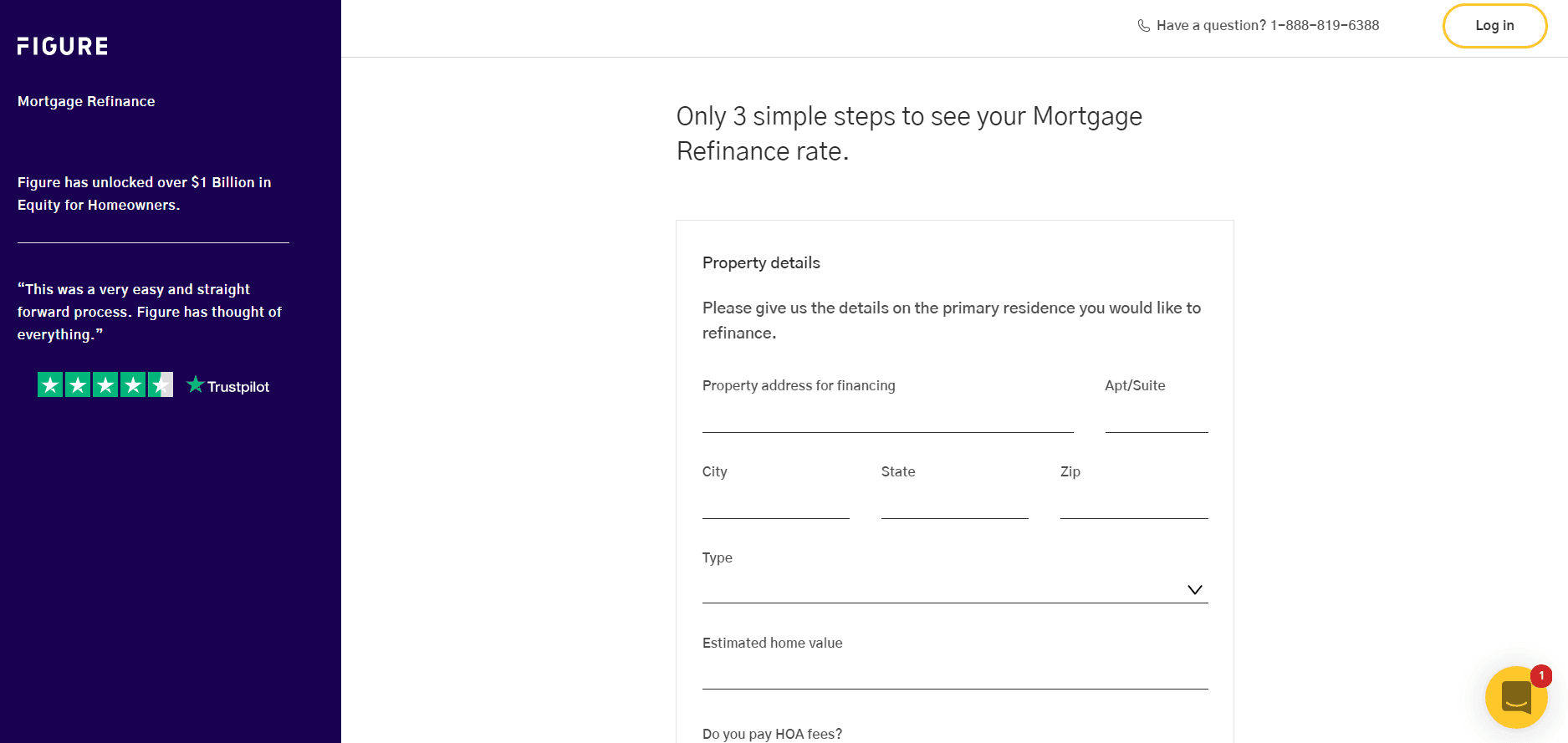

The company is not yet rated with the Better Business Bureau. Figure offers mortgage refinance but its only home equity product is its HELOC. Heres our review of the Figures home mortgage refinance product updated for.

It averages 2 out of 5 stars from 22 user reviews where many customers complained of glitchy technology during the online application process that took days to resolve and made them lose their locked-in interest rates. Of nearly 900 reviews at the time of writing 91 ranked Figure as excellent and another 4 described it as great That compares well with many other lenders. The approval process is online and fully automated making it easy to get a quote on your own terms - no dealing with phone calls to brokers.

Here are a few of the latest reviews weve recieved. The better your credit the lower the rate youll likely get. Dont forget to consider your current lender when shopping options for refinancing.

Heres what some top lenders offer. Learn more about Figure Lending LLC and its products by browsing the services it offers. Figure Lending LLC Review Figure Lending LLC was founded in 2018 and is based in Reno NV.

Overall the website was incredibly easy to use. Figure offers home equity loans for any use including home improvement. Figures rates are competitive in the industry and those with excellent credit may be able to receive lower rates than competing products.

However Figure is different from many other home lenders because of its completely digital experience fast approval and closing and competitive rates and fees. A typical rate on a Figure Purchase Mortgage loan is 273 2836 APR. For the most part these posts are all the same but after reading so many.

Checking loan rates arent supposed to have any impact on your credit score. Mixed customer reviews and an F from the Better Business Bureau plus more than a dozen states whose residents are ineligible for their loans are just a few of the reasons why Figure lands near the bottom of our list. It doesnt fare as well with the Better Business Bureau where it receives an F rating.

Figure is one of the newest ways to get a mortgage refinanced but are they the best. 188 - 564. The company gave a timely response to all three and all were closed with an explanation.

The average loan amount of 41700700 with the average rate above would result in 360 monthly payments of 169798. The process was as easy as they. Figure has received mixed customer reviews to date.

550 FHA VA Movement Mortgage. Figure led me through the application process which was quick and simple a welcome change to other lenders that have lengthy often frustrating applications. You can also read our community reviews and hear what others have to say about their experience with Figure Lending LLC.

This product is mostly recommended by SuperMoney users with a score of 42 equating to 38 on a 5 point rating scale. Average Customer Review out of 5 1 Average 30-Yr Refinance Rate 2020 2 Minimum Credit Score. These businesses generally aim to provide streamlined financial services through the use of technology.

Figure earns an impressive 47 out of 5 from Trustpilot based on over a thousand customer reviews. A typical rate on a Figure Mortgage Refinance loan is 273 2793 APR. All employees were knowledgeable friendly polite and helpful.

They advertise themselves as the Worlds Fastest HELOC - with a loan decision in 5 minutes and funding in as few as 5 days if youre approved. Figure Lending has a rating of F with the Better Business Bureau and an excellent rating with Trustpilot. My wife and I have had numerous loans in our 45 years of marriage and Figure has been the best experience and process ever.

NerdWallets mortgage lender reviews can help you choose the best mortgage and the best lender to suit your home buying needs. Borrowers can get a fixed-rate HELOC between 15000 and 250000 with repayment terms of. Its at 100 if everybody recommends the provider and at.

It doesnt have any regulatory actions filed against it with the Nationwide Mortgage Licensing System. In 2020 the Consumer Financial Protection Bureau received three complaints related to Figures home equity line of credit product. Recommendation score measures the loyalty between a provider and a consumer.

Figure Mortgage Refinance Reviews October 2021 Supermoney

Figure Review My Experience Using Figure

2021 Figure Personal Loans Review Pros Cons More Benzinga