Is Figure A Legitimate Loan Company

Loans demanding processing insurance or even origination fees before approval are. Fig Loans was founded in 2015 as a collaboration.

Figure Review My Experience Using Figure

Loan Up to 8x Your Monthly Income.

Is figure a legitimate loan company. There are several ways to check if a loan company is legitimate. Do a quick online search and look up customer reviews. The company is owned by Figure Technologies Inc.

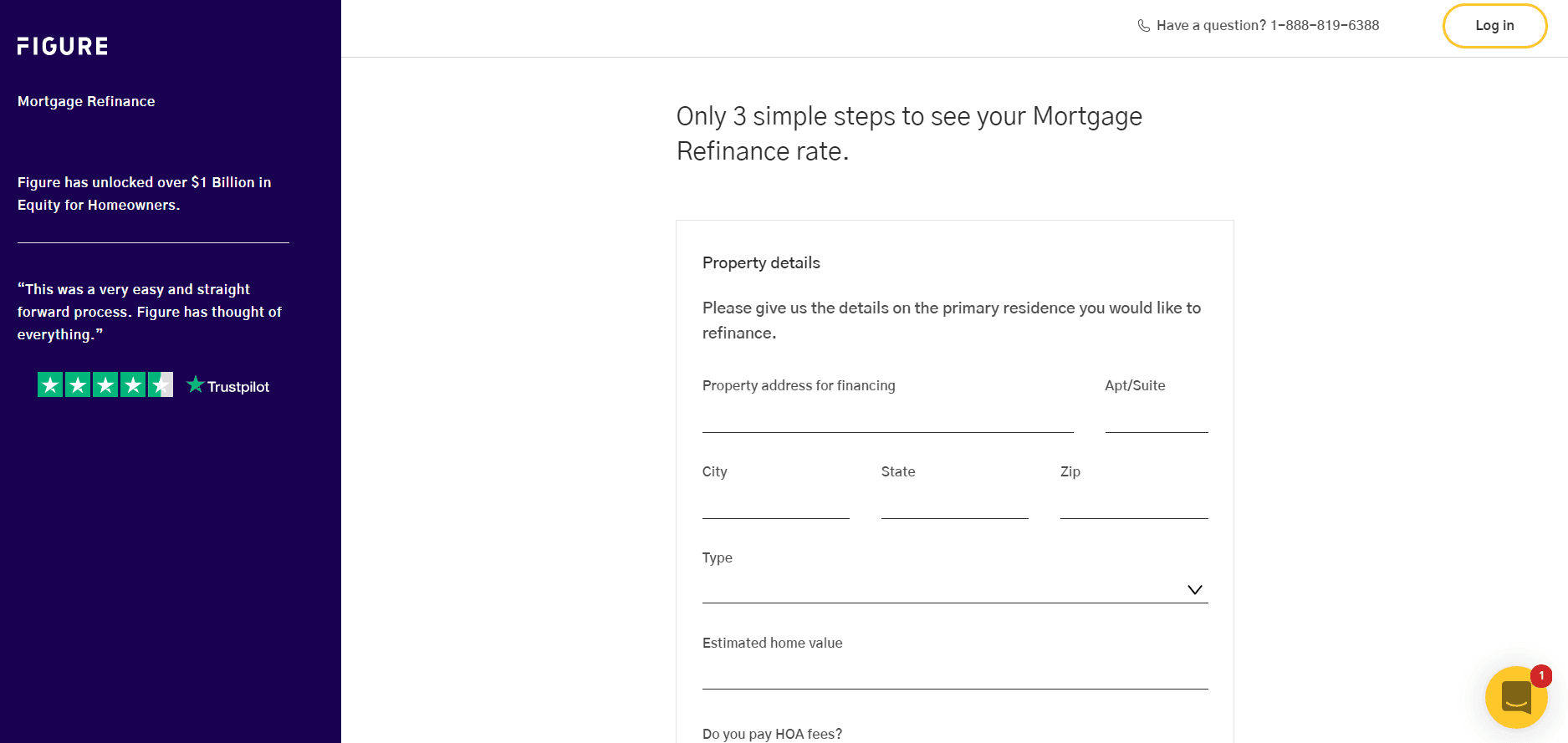

You can access the cash you need without ever leaving home. Real ECA Loans in San Francisco CA. HOME EQUITY LINE MORTGAGE REFINANCE PERSONAL LOAN.

Look for current BBB rating customer reviews. Use these seven personal loan scam warning signs to protect yourself and check if a loan company is legitimate. Ad Loan Up to 8x Your Monthly Income.

Ad Loan Up to 8x Your Monthly Income. Home equity lines of credit from Figure can be used for. Rates will be higher for other applicants.

These scams definitely are loans to avoid so consumers must recognize the signs and how to identify them while still knowing how to spot a legitimate loan company. These businesses generally aim to provide streamlined financial services through the use of technology. Check the companys record on the Better Business Bureaus website.

Fill out our application form select your best offer and receive your money within a day. Ad We will help you find the best possible cash loan today all you have to do is apply. Personal Loan Scam Warning Sign 1.

Remember that a serious loan lender is interested in you. Loan Up to 8x Your Monthly Income. Figure is a lending company that offers several loan products including personal loans.

What youll find there will help you evaluate whether its a legitimate lender that deserves your money and trust or if you must look elsewhere. If you want to know if an online company is legitimate start by trying to find a physical address and contact information on their website since you should be able to contact the business if there is an issue. Founded in 2018 Figure Lending LLC is a finance and technology company that offers homeowners cash-out and traditional rate-and-term refinancing of home mortgages home equity lines of credit personal loans and more.

In addition a contact form or a chat would be a great extra on the website. High-pressure sales tactics are designed to drive you to act quickly often before youre able to spot other red flags. How to check if a loan company is legitimate.

California Florida Illinois Missouri New Mexico Ohio Texas and Utah. Figure is a Charlotte North Carolina-based financial technology company founded in 2018 that offers home equity lines of credit online. The company could be the streamlined loan solution that you have been looking for to efficiently manage your mortgage.

See BBB rating reviews complaints more. Ad We will help you find the best possible cash loan today all you have to do is apply. Fill out our application form select your best offer and receive your money within a day.

As a result the company will provide all possible contact information to help you find it. Figure is a new lender that provides HELOCs in 41 states and the District of Columbia. First check out the loan company on the Better Business Bureau BBB website.

Figure is a financial technology company with the mission of transforming financial services through blockchain. This organization is not BBB accredited. Fig Loans by FigTech is a Texas-based lender that offers payday alternative loans along with credit builder loans in eight states.

Unlike some competitors Figure offers an application process that is completely online. The lowest APRs are for the most qualified applicants based on factors such as credit score debt-to-income ratio credit utilization and credit inquiries. Founded in 2018 Figure is a new lender that provides home equity lines of.

The loan requires payment up front. Home equity lines of credit. No Credit Check Loans.

Figures Personal Loan APRs range from 575 to 2294 inclusive of a 025 discount for enrolling in autopay and is determined at the time of application. Figure is a lending company that currently offers two different products. Legitimate lenders offer steady rates that depend on your credit score and finances.

Figure strives to bring speed efficiency and savings to our members. Online lenders are in the business of making loans and collecting interest when those loans are repaid. Figure offers home equity loans for any use including home improvement.

Also if the site has spelling errors or low-quality images it could be a sign that the company is not legitimate. And is headquartered in San Francisco California. A physical address is the other proof that a company that offers loans online is legit.

Lets take a closer look at what Figure has to offer.

Figure Closes Series C Round Of 103 Million To Expand Lending Products And Executive Hires Business Wire

Figure Introduces Blockchain A Straight Talking But Charming Mascot To Demystify Technology Innovation Business Wire

Figure Review My Experience Using Figure