Figure Bank Home Equity Loan

As there are not exactly 26 fortnights or 52 weeks in a year this is not a precise conversion. Loan limit determined by your home equity market value of.

Figure Review My Experience Using Figure

Youll receive a prequalification decision within minutes.

Figure bank home equity loan. Any money you put into this account is deducted from your loan balance meaning youre only charged interest on the difference. The fees are different too. Its a hybrid loan combining the traits of a traditional home equity loan and a home equity line of credit HELOC.

Figure offers fixed-rate home equity lines of credit and mortgage refinancing. A home equity line of credit allows you to borrow money against the value of your home provided you owe less than your home is worth on your current mortgage. But your personal limit depends on your credit score and Figures lien position.

Figures Home Equity Line enables you to take out a loan ranging from 15000 to 250000 against the equity in your home. Ad Looking for a cash loan in Singapore. You wont need an in-person appraisal and even their notary services are provided via video in some states.

The minimum home equity line of credit amount is 15000 or 25001 in Alaska and Wisconsin and the maximum is. Home equity loans provided by Regions Bank have no closing costs and each comes with a fixed interest rate for the life of the loan. The initial amount funded at origination will be based on a fixed rate.

For example for a borrower with a CLTV of 45 and a credit score of 800 a five-year Figure Home Equity Line with an initial draw amount of 50000 would have a fixed annual percentage rate APR of 499 and a 499 origination feeThe total loan amount would be 52495. There are a number of ways you can build equity in your home. Your equity helps your lender determine your loan-to-value ratio LTV which is one of the factors your lender will consider when deciding whether or not to approve your application.

Figure offers the fastest way to turn your home equity into cash for what matters now. For now though Figure is best known for its Figure Home Equity Line product. The Figure Home Equity Line is the first such all-digital product offering a home equity loan decision in five minutes and funding in five days.

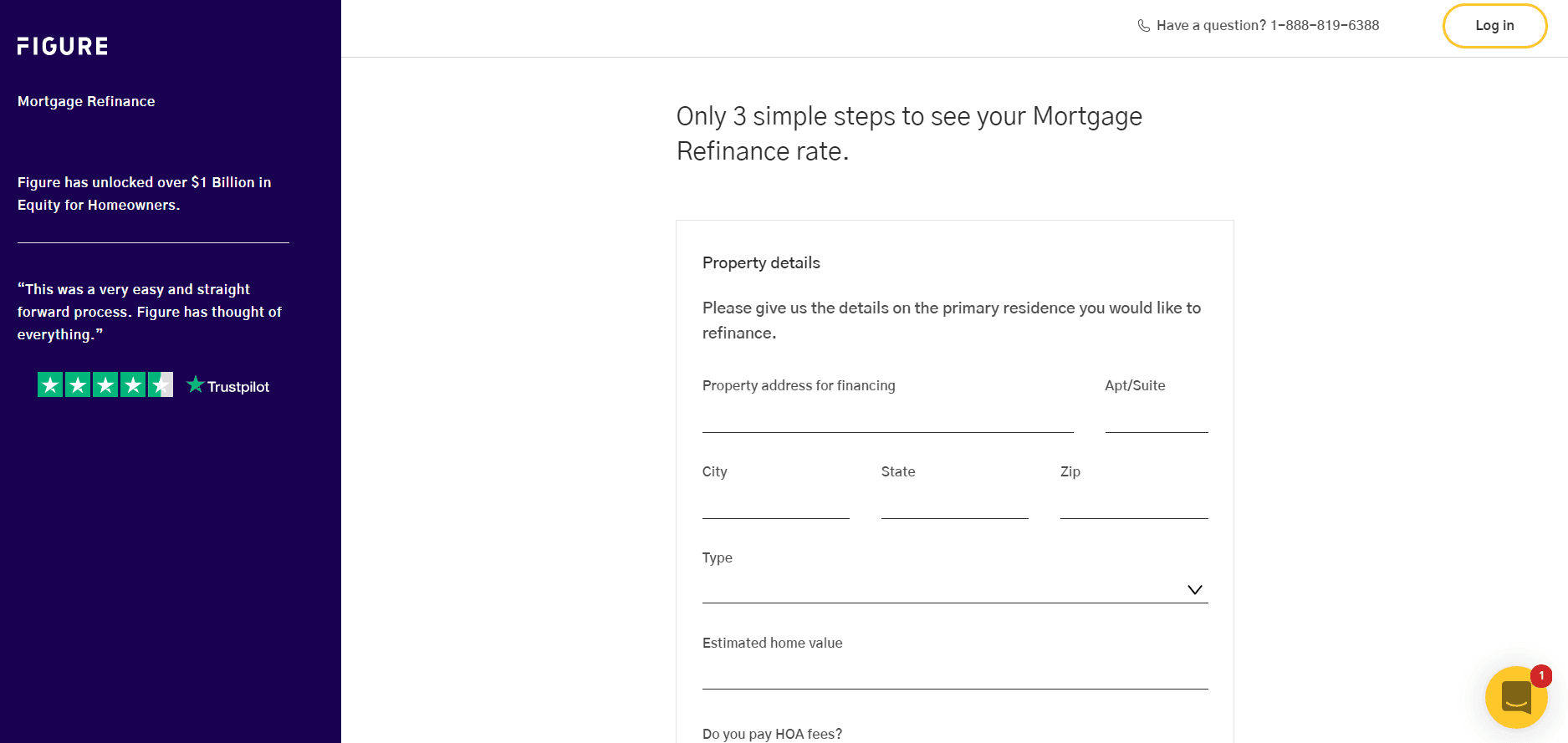

2 steps to apply for a Figure home equity loan. Fill out our fast simple application form and compare multiple cash loan offers for you. If you have chosen to view a weekly or fortnightly repayment amount we have taken the monthly amount multiplied it by 12 and then divided it by 26 for a fortnightly amount or 52 for a weekly amount.

Your home equity is the difference between the appraised value of your home and your current mortgage balances. Starion Banks experienced lenders can help you figure out how much you can borrow and discuss all the advantages. Home Equity Fixed 1st Lien Position Loan Amounts 20000 to 500000.

Fixed interest rates keep your monthly payments stable. Open an Everyday Offset. Unlike many home equity loans and HELOCs which charge a variety of fees Figure charges only an origination fee which ranges from 0-3 of the original draw amount.

The Figure Home Equity Line is an open-end product where the full loan amount minus the origination fee will be 100 drawn at the time of origination. This is a loan that allows you to tap into your home equity to obtain funds for various uses including big purchases and debt consolidation. Figure allows a maximum combined loan-to-value ratio CLTV of 95 which is high by industry standards.

With this lender youll need to borrow a minimum of 15000 25001 in WI and AK and the maximum. We get you personalised offers in no time for free. Lock in a lower rate with the option to redraw up to 100.

You can then express this as a percentage of the appraisal value of the home to compare with the 20. Ad Looking for a cash loan in Singapore. To calculate the equity on your home subtract the amount owed in mortgage loans for the home from the current appraisal value of the home.

However this product contains an additional draw feature. The initial amount funded at origination will be based on a fixed rate. The entire application process takes only a few minutes to complete.

For example if you have 100000 in your offset account and your home loan balance is 300000 youll only pay interest on. The more equity you have the more financing options may be available to you. A home equity loan should primarily be used for home improvements that will increase the value of your home.

The initial amount funded at origination will be based on a fixed rate. Complete the questionnaire pop-up and then select I agree. The Figure Home Equity Line is an open-end product where the full loan amount minus the origination fee will be 100 drawn at the time of origination.

Home equity loan terms are available in 7 10 or 15 years and the total borrowed amount can range from 10000 up to 250000 depending on the type of property used as collateral and the lien position. Select Find my rate from Figures homepage. Get all your loan money at once.

Borrowers can get a fixed-rate HELOC between 15000 and 250000 with repayment terms of. The Figure Home Equity Line is an open-end product where the full loan amount minus the origination fee will be 100 drawn at the time of origination. Figure offers mortgage refinance but its only home equity product is its HELOC.

We get you personalised offers in no time for free. Figures loan terms are five 10 15 or 30 years which you pay back on a fixed payment. However this product contains an additional draw feature.

Home equity loan rates start at 380 APR for both 10 and 15-year term repayment periods while HELOC rates begin at 345 APR and go up to 860 APR. Using a home equity loan to invest in real estate or any other investment should be. However this product contains an additional draw feature.

Bank offers home equity loans and HELOCs both without closing costs. Fill out our fast simple application form and compare multiple cash loan offers for you. List Drop down Home Equity Fixed 1st Lien Position Loan Amounts 20000 to 500000 Home Equity Fixed 2nd Lien Position Loan Amounts 20000 to 500000 Home Equity Line of Credit Prime 75 Loan Amounts 25000 to 500000.

Figure offers home equity loans with an all-online process that can deliver approval within just five minutes.

7 Best Home Equity Loans Of 2021 Money

Figure Home Equity Loan Review 2021 Us News

How To Calculate Equity In Your Home Nextadvisor With Time