Figure Heloc Origination Fee

While there are several fees Figure leaves out of the mix homeowners who qualify for a home equity line of credit may pay an origination fee. Generally speaking any rate below the.

Figure Home Equity Line Of Credit Review Heloc 2020

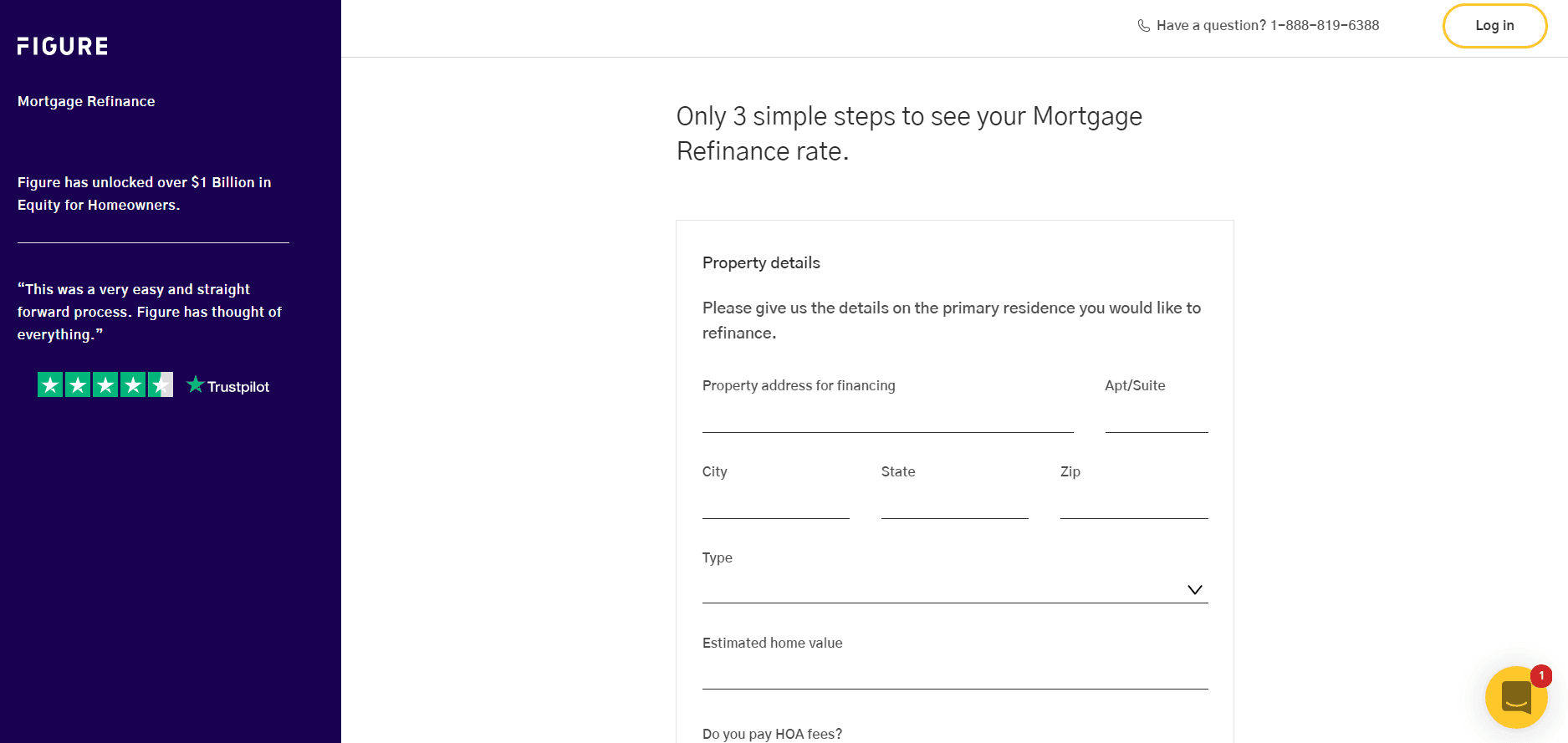

If youre considering Figures Home Equity Line product its important to understand the terms and conditions.

Figure heloc origination fee. At the moment you can use Figure in most states but there are still a few locations where theyve yet to break ground. Unlike other companies offering HELOCs Figure does not charge account opening fees or account maintenance fees or even prepayment fees. Loan origination fee Varies.

Annual Maintenance Fee. Subordination fee will be assessed if you ever ask Figure to agree to changing lien position. Youll just pay an origination fee and a fixed interest rate based on market conditions and your creditworthiness at the time of taking out the loan.

You also pay off the extra 1500 in your loan balance for a grand total of 1551829. The firm charges a 300 subordination fee and a 0 to 100 release recording fee which varies from applicant to applicant. For example for a borrower with a CLTV of 45 and a credit score of 800 a five-year Figure Home Equity Line with an initial draw amount of 50000 would have a.

Figures only fee on its personal loan product is a standard origination fee ranging from 0 to 3. Where Is Figure Currently Available. These loans have an average APR of 499 to 1425.

Figure does not charge any prepayment or check processing fees. You may also be responsible for paying recording fees which vary by county as well as a subordination fee if. Unlike other home equity products Figures HELOC requires homeowners to take the full amount.

Our APRs start at 300 for the most qualified applicants and are higher for other applicants. Origination fee of up to 499 of the initial draw amount depending on the state where your property is located. Heres what you can expect.

Just like a regular credit card maintenance fees for a HELOC are charged every year regardless of whether the line has been used or not. Document preparation and attorney fees Varies. You may also be responsible for recording fees.

Figure charges an origination fee which can range from 3 percent to 499 percent of your initial draw amount depending on your location. 22 2021 is 388 percent. Figure charges an origination fee up to 499.

Figures Home Equity Line may charge a loan origination fee of up to 499 of the loan amount. The usual cost is about 50 to. Figures annual percentage rates range from a low 475 up to 1375.

An origination fee is compensation charged by the lender to process a new loan application. Depending on the amount of your HELOC this can add up quickly. With a traditional mortgage or HELOC the lender charges thousands of dollars in fees including origination fees points processing fees underwriting fees courier fees and junk fees Figure charges one single origination fee which you pay upfront when you take out the loan.

Automatic payment discount of 075. Title search 75 to 100. Figure origination fees are 0 for the best-qualified borrowers 3 or 499 depending on the application details and amount of the line of credit.

There is an origination fee 0 499. The average HELOC rate as of Sep. As you evaluate your options keep in mind that not all lenders charge the same closing costs.

Figure does not charge a prepayment. And if youre taking out in a VA loan a maximum origination fee of 1 remains in place. The origination fee is 1500 resulting in a loan balance of 51500 and you repay the loan over ten years.

Despite its convenient fast and super user-friendly offering the only gripe that we do have with Figure is its origination fee. A maximum of 6000 in origination fees may be charged on FHA reverse mortgages regardless of the total loan amount. This is a small payment usually 15 to 50 made to the local taxing authority where your home is located such as the county recorder or other local official to record the new lien against your home.

However the origination fee may be up to 499 of the entirety of the loan. As of publishing APRs can be as low as 288 2 for home equity lines includes autopay and credit union membership discounts as well as payment of an origination fee in exchange for a reduced APR. What fees does Figures Home Equity Line charge for a HELOC.

With a maximum origination fee of 499 this could be very costly in the long run especially if the size of your home equity loan is a six-figure sum. Smaller Home Loans May See Higher Fees Percentage Wise. Recording fees that vary depending on the county.

Because the loan origination fee is percentage-based. Figure charges an origination fee of up to 499. Granted the exact amount of the origination fee varies depending on your credit profile and the state in which your property is located.

Your monthly payment is 54599 and you pay 1401829 in interest over the life of the loan. If you have below-average credit youll likely fall within the 9 percent to 10 percent range. There are no other fees not even late payment fees if you miss a payment.

You will be responsible for an origination fee of up to 499 of your initial draw depending on the state in which your property is located and your credit profile. Figures loan products come with convenient and transparent fees as follows. In terms of cost they charge a 1 loan origination fee which is common though not all mortgage lenders charge such as fee.

What types of property can you use as security for a HELOC with Figures Home Equity Line. Notary fee 50 to 200 per signature.

Figure Home Equity Review 2021 Finder Com

Home Point To Offer Digital Helocs Through Figure

Figure Home Equity Line Of Credit Review Heloc 2020